Wednesday, July 28, 2010

Porsche has just announced that it's putting the 918 Spyder into production. First unveiled at the Geneva Motor Show earlier this year,

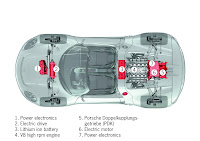

The 918 Spyder offers the performance of a super sports car, with a top-end speed of 198 mph and acceleration from a standstill to 100 km/h in just under 3.2 seconds. Its high-revving V8 combustion engine pumps out more than 500 horsepower, and is paired with two electric motors: one on the front axle, and one on the rear, which add an additional 218 horsepower to the mix.

The petrol part of the 918's drivetrain is a 500bhp mid-mounted V8 engine that is shared with Porsche's RS Spyder race car. This is combined with a pair of electric motors that add another 218bhp to the 918's tally. One motor drives the front wheels while the rears are powered by both the petrol engine and the remaining electric unit.

The Spyder is planned to provide an outstanding 78 mpg, putting even your Prius to shame. What kind of price tag does a car with this unique combination of supreme performance and low fuel consumption come with? A starting price of $630,000.

Press Release

Decision taken by the Porsche Supervisory Board

Green Light for Series Development of the 918 Spyder

Stuttgart. In its session today, the Supervisory Board of Dr. Ing. h.c. F. Porsche AG, Stuttgart, gave the green light for series development of the Porsche 918 Spyder. Reflecting the overwhelming response from the public and customers to the Concept Study, the Supervisory Board gave Porsche's Board of Management the mission to develop a production model based on the car already presented. This concept version of an ultra-high-performance mid-engined sports car with plug-in hybrid technology made its debut at the 2010 Geneva Motor Show and at Auto China in Bejing, hitting the headlines worldwide.

Michael Macht, President and Chairman of the Board of Management of Porsche AG: "Production of the 918 Spyder in a limited series proves that we are taking the right approach with Porsche Intelligent Performance featuring the combination of supreme performance and efficient drivetrain concepts. We will develop the 918 Spyder in Weissach and assemble it in Zuffenhausen. This is also a very important commitment to Germany as a manufacturing base."

The Concept Study of the 918 Spyder allows CO2 emissions of just 70 g/km, corresponding to fuel consumption of 3.0 litre/100 km (94.1 mpg imp) in the NEDC, on the one hand, and the performance of a super-sports car, on the other. This extremely efficient drivetrain technology then forms a symbiosis in the 918 Spyder with truly outstanding design and high-tech motorsport achievements. Further product details of the 918 Spyder will be disclosed in the months to come.

Labels: German, Hybrid, Porsche, Production, Supercars

Thursday, March 18, 2010

The Volkswagen Transporter was first produced in March 1950, making this month its 60th anniversary. The popular van has subsequently sold over 10 million units worldwide and gone through five generations of evolution. The latest T5 facelift was launched in the fourth quarter of 2009 and comes in styles such as the people-carrying Caravelle as well as the campervan California.

That first model, the T1, featured a four-cylinder, air-cooled, 1.1-litre petrol engine typically fitted at the rear end. It made 18 kW (25 PS / 25 bhp) and could muster a top speed of 97 km/h (60 mph) when really pushed.

In comparison the latest T5 model is powered by a 2.0-litre common rail turbo diesel unit pushing out between 62 kW (83 bhp / 84 PS) and 132 kW (178 bhp / 180 PS), and can run up to 192 km/h (119 mph).

Over the years the Transporter became an icon for both business and leisure use. From rock bands to fleet managers, to families of seven, people bought it for its generous interior space and comfort.

HAPPY 60TH BIRTHDAY TO THE WORLD'S MOST POPULAR VAN

Production of the Volkswagen Transporter van officially started in March

1950 and during the 60 years since then it has become one of Volkswagen

Commercial Vehicles' best-selling models globally, the number one imported

van in the UK as well as one of the most iconic and popular vans in the

world.

With over 10 million produced, the Volkswagen Transporter has evolved

through five generations of functional and practical bodystyles, each

representing the ultimate multi-purpose vehicle of its time and loved by

business and private users alike for transporting goods or people for work

or leisure. This unique heritage is the focus of the current ‘Evolution of

Van' advertising campaign for the new Transporter which was launched in the

UK in January.

The first T1 ‘split-screen' model was powered by a four-cylinder,

air-cooled, 1.1-litre petrol engine mounted at the back of the vehicle. It

produced 25 PS of power and had a top speed of about 60 mph. By comparison,

the new Transporter enjoys the refinement of Volkswagen's latest 2.0-litre,

common rail, turbocharged diesel engine, available with power outputs

ranging from 84 PS to 180 PS and a top speed of up to 119 mph, plus the

latest stability control systems and braking technology that would have

sounded like something from a science fiction novel 60 years ago.

Although the design has evolved over the years, the first and the latest

Transporter share the same badge on the front and the same design principles

of a generous loadspace and an enviable reputation for quality and

durability.

Similarly, comparing the latest Volkswagen California with a T1 campervan

shows that both make efficient use of the space available to create a

vehicle equally suitable for daily trips to work or the shops, as for

weekend escapes or continental capers.

Over the years, Volkswagen Transporters have endured challenging round

the world trips by enthusiastic travellers, been used as the preferred

choice of travel for rock bands since the 1960s to the present day, and been

relied upon by many businesses needing a fleet of delivery or passenger

carrying vehicles.

The first Transporter was imported into the UK in 1955, and the latest

version of the van as well as today's people-carrying and campervan

versions, the Caravelle and California, arrived in the UK this January, 55

years later.

Labels: Classics, German, Production, Volkswagen

Tuesday, February 23, 2010

BMW plans to assemble their electric cars at a manufacturing facility in Leipzig, Germany. Amongst these vehicles is a subcompact, referred to internally as the "Megacity," which the automaker plans to release midway through 2013 with a different name.

“The BMW Group will build the car of the future in Leipzig with high-tech innovations from Bavaria,” BMW CEO Norbert Reithofer said in a statement. “The main reasons behind this decision are the qualities that Germany has to offer: we have a tried-and-tested production network here and high levels of education and outstanding competencies at our disposal.”

BMW plans to launch an entire family of electric vehicles from the Megacity subcompact, which is designed for major metropolitan areas. BMW hasn't decided on a production name for the car.

A heavy use of carbon fiber will help keep the Megacity lightweight. A joint venture with BMW and SGL Group will produce a carbon fiber fabric that will later become carbon fiber reinforced plastic. The automaker has not said what parts will be made from the material.

At the Detroit auto show in January, BMW presented its ActiveE concept, an electric-drive vehicle based on the 1-series coupe. Next year, BMW development chief Klaus Draeger plans to launch another test fleet of electric cars based on the ActiveE.

More Photos

Labels: BMW, Electric Vehicle, German, Industry, Production

Thursday, February 4, 2010

10 million sales by 2018 is new goal

BY ANDREAS CREMER

BLOOMBERG NEWS

Volkswagen, Europe's largest carmaker, said it plans to increase sales to more than 10 million vehicles by 2018 as it seeks to dethrone Japan's Toyota.

VW's management board approved business targets, including profit margins, measured by earnings before interest and taxes, of at least 5% for the automotive business in the "medium term," Wolfsburg, Germany-based Volkswagen said in a statement Wednesday. The target doesn't include Porsche, which will be integrated by 2011, it said.

Volkswagen CEO Martin Winterkorn has a target of beating Toyota, the world's biggest carmaker, in global deliveries and profit margins. VW sold 6.29 million cars and SUVsworldwide last year, an increase of 1.1% from 2008. Toyota said last month that 2009 vehicle sales, including those of affiliates, fell 13% to 7.81 million vehicles.

"It shows plenty of ambition in the whole Volkswagen Group," said Stephen Pope, chief global equity strategist at Cantor Fitzgerald in London. "By being able to learn from Porsche's discipline, it gives them that extra springboard."

By 2018, Volkswagen, which includes the Audi luxury division and Czech unit Skoda, should have a pretax profit that exceeds 8% of sales, the company said.

Volkswagen shares fell 18 cents, or 0.3%, to 65.72 euros after rising as much as 1% on the Frankfurt exchange before the announcement. The automaker has a market value of 25.7 billion euros ($36 billion).

"With the implementation of 'Strategy 2018,' the Volkswagen group is seeking global economic and environmental leadership in the automotive industry by 2018," VW said in its statement. The plan would include "significant cost cutting, in part through the more prominent use of the modular design principle."

VW foresees steps to promote research and development of hybrid and electric cars, according to the statement. VW will also maintain "strict discipline" on spending and aim to keep the expenditure on fixed assets in automaking at about 6% of sales in the medium and long term.

Labels: Corporate/Financial, German, Industry, Production, Toyota, Volkswagen

Tuesday, February 2, 2010

ZEEWOLDE, The Netherlands (1 February, 2010) - In advance of the General Meeting of Spyker shareholders, to be held on 12 February 2010, and which was convened on 28 January 2010, Spyker Cars N.V. ("Spyker") provides further strategic and financial details regarding its acquisition of Saab Automobile AB ("Saab").

ACQUISITION RATIONALE AND SAAB BUSINESS PLAN

Spyker believes that through the purchase of Saab it has a rare opportunity to acquire and rebuild a global car brand which will be repositioned towards an independent performance-oriented niche car company with an industry-leading environmental strategy. Saab's brand DNA is unique and rooted in its aeronautical heritage, innovative and independent thinking and its Swedish origins. Spyker fully supports Saab's Business Plan which will be implemented by Saab management. The Business Plan, drawn up by Saab management over the past ten months, was analysed by Spyker in assistance with Booz & Co and KPMG Transaction Services, advisors to Spyker. The Business Plan has also been analysed and supported by several advisors to the Swedish Government and the EIB.

At the General Meeting, Spyker Cars N.V. intends to adopt a resolution to change its name to Saab Spyker Automobiles NV ("Saab Spyker"). This entity will operate Spyker and Saab as two separate operating companies, each focused on its distinct target markets with their respective vehicle lines. As previously stated, Saab Spyker is committed to execute the Saab Business Plan. It is the intention to enhance it in several areas. The highlights of Saab's strategy will be:

* Saab will be a stand-alone niche manufacturer with three to four model lines: 9-3 (sedan, hatchback, sports estate, X and convertible) and 9-5 (sedan, sports estate and X) and the 9-4X for both the US and European markets. In addition, Saab will investigate the potential of adding a fourth smaller car line ("9-1") in due course provided that the positive development of the smaller car segment continues. However, this model is currently not envisaged in the Business Plan so if the outcome of the investigation is positive, additional financing to develop this model could be required.

* Saab's product portfolio will be renewed completely, beginning with the launch of the new 9-5 early this summer, the new 9-4X in early 2011 and the new 'all Saab' 9-3 in 2012.

* Saab will continue to be repositioned against other brands such as Audi (A4/A6) and BMW (3/5 series) as a premium brand, leveraging its strong and unique brand heritage.

* Saab's Technical Development Center in Trollhättan has full capability in developing complete vehicles and will continue to do so. In areas such as safety, environment, driving characteristics, practicality, turbo technologies and several other innovations, the Saab brand is among the best in the industry.

* With Trollhättan as one of the most efficient mid-size car plants in Europe, production and sales volumes are aimed to be rebuilt to recent pre-crisis levels of about 100,000 to 125,000 vehicles including the 9-4X built in Mexico.

* The current dealer network will be re-energized with a new sales and distribution approach in certain markets, which will be implemented during 2010.

* The economies of scale of the on-going collaboration with GM after Closing the acquisition (February 2010) will continue to be leveraged in sourcing via ancillary agreements, with independent sourcing gradually increasing to reduce GM dependency and obtain improved access to other suppliers and the co-development of unique innovations.

Saab Spyker believes that its two brands, both deeply rooted in aeronautical and automotive history, will benefit from sharing certain assets and technology services. Examples include but are not limited to:

* Saab's extensive global network of 1,100 dealers.

* The extensive engineering know how and innovative technologies available at Saab.

* Sharing of activities in marketing & sales: i.e. merchandising, promotion & sponsorship activities, etc.

In the future, the two brands will be able to share certain parts and components and expect to obtain access to supplier and partner resources not available to Spyker or Saab individually today.

FUNDING OF SAAB

The Saab Business Plan requires approximately $1 billion in peak funding for Saab in advance of the return to profitability, forecast to occur by 2012. The funding is provided in part by GM, through $326 million Redeemable Preference Shares ("RPSs"), and in part through other contributions, which concern various substantial contributions to the funding of Saab's Business Plan on favorable terms for supplies by GM to Saab and deferred payments from Saab to GM. The remaining amount, apart from cash at bank, is to be provided by a EUR 400 million loan from the European Investment Bank for certain R&D projects at Saab. Securing this EIB loan is a condition precedent to closing of the Saab acquisition ("Closing").

With this financing in place, the business plan does not envisage any future funding being required, neither from Spyker or elsewhere, for Saab to return to profitability. The business plan targets car production and sales at or below historical levels of 100,000 to 125,000.

Explanation on the two sources of funding:

Redeemable Preference shares

At Closing, GM will convert USD 326 million of pre-closing receivables on Saab into RPSs in Saab. The issue of the RPSs will therefore NOT cause any dilution for the shareholders in Spyker. The voting rights attaching to these RPSs constitute 0.0005% of the total voting rights in Saab. The other 99.99% of the voting rights (100% of the ordinary shares) will be held by Spyker. Since the RPSs are capital and not a loan, no interest is due at any time by Saab. The RPSs carry no dividend from Closing until December 31, 2011. A dividend entitlement of 6% starts from January 1, 2012 through June 30, 2014 and increases over time to 12% as from July 1, 2014 until the scheduled redemption date of December 31, 2016. The dividend over 2012 will be added to principal, but as from fiscal year 2013 the dividend is payable in cash. Should Saab have insufficient distributable reserves to pay the cash dividend it will be added to principal increased with a penalty factor of up to 4%, but such that the total dividend entitlement will never exceed 12%.

In the period 2010-2016, the average dividend payable is about 4%, which is considerably below the average interest on a comparable subordinated loan.

The RPSs qualify as equity and therefore, if Saab cannot pay dividends or redeem the RPSs, Saab will not be in default but the RPSs will simply continue to accrue. Also, the RPSs cannot be redeemed as long as the EIB loan is not yet fully repaid. The Saab Business Plan envisages redemption of the RPSs starting in 2016 out of retained profit, without additional funding (from Spyker or anyone else) being required.

EIB loan

The Share Purchase Agreement is subject to the execution of a EUR 400 million loan agreement between Saab and the European Investment Bank ("EIB"), for which a guarantee was obtained from the Swedish Government on January 26, 2010. This loan will be issued to Saab. All amounts payable by the EIB are specifically earmarked to the Euro for designated Saab projects and capital expenditures and represent 50% of these projects or capital expenditures. The projects mainly relate to increasing fuel efficiency and clean car technology. The remaining 50% is funded by Saab itself pursuant to its Business Plan. Spyker will not have any access to the EIB funds which are completely ring-fenced nor will it pay any part of the Purchase Price with proceeds from the EIB loan. The guarantee is subject to approval by the European Commission. Saab and the Swedish Government have provided all required information to the EC prior to the issue of the guarantee so the decision by the EC is expected very soon.

FUNDING OF SPYKER

Spyker's existing bank loans in the aggregate amount of EUR 57 million are refinanced by Tenaci Capital B.V. ("Tenaci"). The terms and conditions of this loan will mirror those of the existing loans it repays, including the right to convert EUR 9.5 million into ordinary shares at EUR 4.00 per share. The term of the loan is 12 months and the interest 10 percent above Euribor. After payment of the last instalment of the Purchase Price, Tenaci has the right to collateralize the loan on terms and conditions identical to those on which the existing loans were collateralized.

The Purchase Price of Saab amounts to USD 74 million (EUR 53.23 million at the current exchange rate of 1:1.39). The first instalment of USD 50 million, to be paid on Closing, will be paid as follows: USD 25 million is borrowed from Tenaci at the same interest rate as the other funding extended by Tenaci, without the right to convert into shares. This amount is currently already in escrow with General Motors.

The other USD 25 million is financed through a share issue, largely through a commitment from GEM Global Yield Fund Ltd under an equity facility concluded between Spyker and GEM. Spyker currently does not intend to draw in excess of USD 25 million under this facility.

The second instalment, USD 24 million, will be payable on July 15, 2010. Spyker has been approached by various investors to fund this instalment. Spyker intends to finance this amount primarily through senior debt (senior to the debt owed to Tenaci), but does not rule out other alternatives. Spyker has committed to pledge its assets to GM as security for this final tranche.

FUNDING OF TENACI

Tenaci's equity is wholly owned by Investeringsmaatschappij Helvetia B.V., the personal holding company of Mr. Victor Muller. Tenaci obtains its debt funding from sources that wish to remain anonymous and with which Tenaci has entered into non-disclosure agreements. The terms and conditions of Tenaci's own financing do not impact Spyker or Saab in any way.

Tenaci has successfully bought Mr. V. Antonov's current shareholding in Spyker consisting of 4.6 million ordinary shares, subject to closing of the Saab acquisition. Currently Tenaci has no plans to make a public offer on all of the issued shares in Spyker.

More Photos

Labels: Corporate/Financial, European, Production, Saab, Spyker